Crypto Drama in 2023?

2022 has been quite a year in the crypto world

2022 a crypto year in crypto with “contagion” and collapses

Crypto isn’t dead or dying though - cool tech is being built

More contagion likely ahead in 2023 amid mixed markets

Yet crypto fascinating as infrastructure and tech innovates

It’s been an interesting year for crypto, surely one that will be remembered for the ages. History might later define 2022 as one of “contagion”. This is the concept that the ecosystem is more connected than people think, and one failure can lead to other crypto collapses.

That being said, new chapters turn over, and 2023 is here. Time for a quick look at some things that could be in the cards for crypto.

It will be nice to review and reflect on this post in twelve months.

At Least One More Big Implosion

It’s hard to believe contagion is over in the crypto markets. Binance is still hanging around, the albatross everyone knows about but often doesn’t want to acknowledge. Digital Currency Group still faces financing woes from a $1b+ hole in its balance sheet.

What other crypto entities out there have been able to stay alive, but barely? Amazingly, there’s still some crypto lenders operating. And, there’s still this looming problem of highly unregulated stablecoins underpinning the market.

There’s no way there isn’t another high-profile implosion on the way for 2023. It could be a very well-known player. It could be some arcane thing no one ever thought would become problematic.

Whatever the case, it feels like more is to come in 2023.

New custody concepts

Crypto’s got a bit of a custody problem, one that needs fixing if mass adoption is ever going to work. And with the FTX situation, it’s clear centralized entities can’t always be trusted with holding crypto for users.

The basic concept of custody is this: Who controls someone’s funds? In the traditional finance world, the custody issue is handled by banks and regulators to protect people’s assets. In crypto, it’s a lot more nebulous.

Crypto users have a lot more control versus assets like stocks. Yet that amount of control can be problematic, including total loss of funds. Expect to hear more about hosted custody at already trusted intermediaries, self-custody or even semi-custody.

Improved custody tech can onboard billions to crypto - a 2023 topic.

Web3 social

Elon is making more media headlines than improving Twitter’s product right now. But it’s early in his tenure as owner of the company. More time for Musk will ferret out whether he can improve the social network for its users.

Elon’s instincts are probably that social media is ready for an upgrade. Twitter co-founder Jack Dorsey has expressed his regret that the social network wasn’t designed to be an open protocol. It doesn’t mean that can’t happen.

Two web3 social products I hear about most right now are Farcaster and Nostr. Both have underlying cryptocurrency and blockchain tech. But they aren’t easy to use, and traction is tough in the space because users need a catalyst to switch.

I do expect we’re going to hear a lot more about Web3 social in 2023, however.

Bitcoin mining flaws

I’ve written a bit already about how bitcoin price has been suspiciously steady amid calamity. Some of this is likely exposing flaws in the thinking around big business bitcoin mining that has developed.

There’s nothing inherently wrong with proof-of-work mining. However, the reality is that the hobbyist and distributed ethos of bitcoin has a couple rips in it because of commercial-grade bitcoin mining.

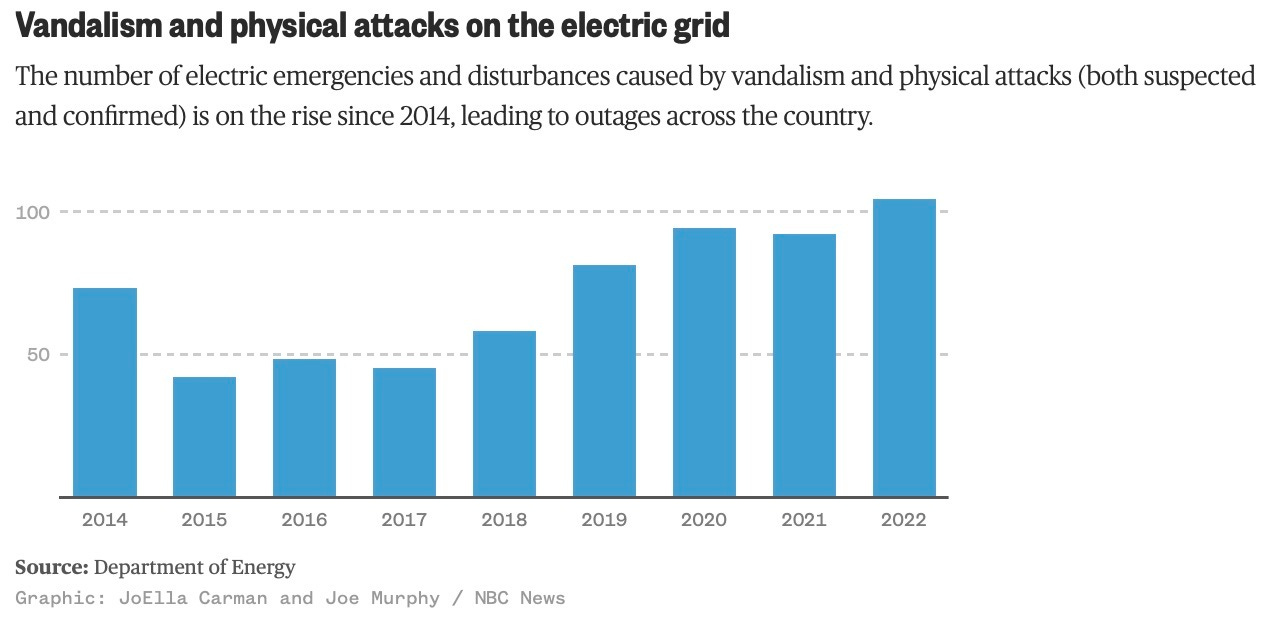

It has developed into an industry of equipment, data centers and power capacity. All of it is based on the price of a volatile asset. That’s silly when power substations are being attacked and hash rate drops when weather gets too extreme.

Expect lower bitcoin prices, and miners struggling tremendously in 2023.

Proof of Physical Work

On a brighter side, I see huge potential in the future of what is known as proof of physical work. This is a form of cryptocurrency mining that generates coins for doing physically verifiable tasks.

A great example of this concept is the walking/running app Stepn, which runs on Solana and Binance Smart Chain. I’m going to go into a deeper dive on this app at some point as I’ve been using it a lot this past year. But basically, you walk around, and are rewarded crypto for doing so.

Stepn feels like a great matchup of incentives, cryptocurrency and a healthy lifestyle. Genopets is another example of this. I’m not sure the tokenomics of these apps are properly aligned, but that’s a small critique.

Expect to hear more of the phrase proof of physical work in 2023.

DAOs

Decentralized Autonomous Organizations are software-based communities that come together to achieve a common goal. These goals are enforced by software, via smart contracts that enable voting, tokens and governance.

There are thousands of these DAOs in existence today, most of them on Ethereum. An example is ConstitutionDAO, which was formed to gather capital from its community to buy and collectively own a copy of the U.S. Constitution that was up for sale.

There was a flaw in this concept, however. Because ConstitutionDAO’s activity resided on a blockchain, a single person was able to outbid the community because the person knew how much money was in the ConstitutionDAO contract.

More interesting stories about DAOs like this will develop in 2023.

Final thoughts

Crypto is always full of drama. There’s probably more to be revealed in 2023 regarding all the failures and blow ups that have occurred post-FTX. Nevertheless, the next year or so should be a great time for everyone to BUILD.

Wishing you all a happy and prosperous 2023. Please share in the comments your thoughts about crypto over the next year.

Thanks for reading. Onward!