Crypto's Global Mobile Opportunity

7.7 billion smartphones by 2027

It’s a time for those in the crypto industry to BUILD

Mobile money services are increasing the adoption of e-money

One of the greatest opportunities is crypto in developing markets

As smartphone adoption permeates, DeFi could become very popular

2022 was a pretty crazy year for crypto. 2023 might be even crazier with the SBF saga, Digital Currency Group’s financial woes and Binance hanging in the wind.

But there’s definitely a silver lining here. Builders are building. Perhaps the biggest opportunity for crypto is that globally, people are using money on their phones more often than ever.

Crypto will be a big part of that for the builders out there. Preparation is going to meet opportunity.

The Global Mobile Big Picture

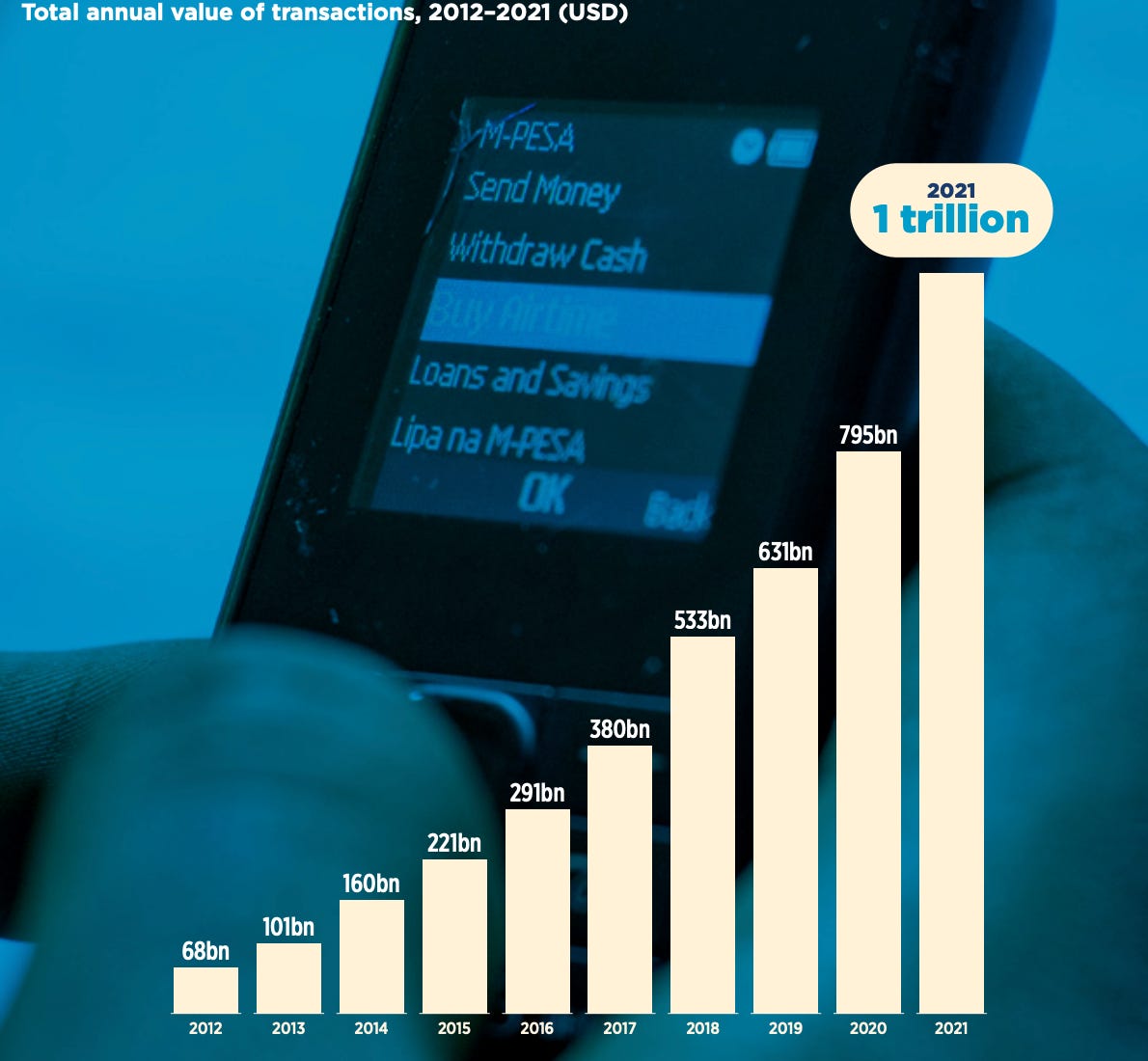

In the past ten years or so, money services on mobile phones globally have almost doubled. In 2012 there were 169 mobile money services in 71 countries. In 2021, that number grew to 316 services in 98 countries.

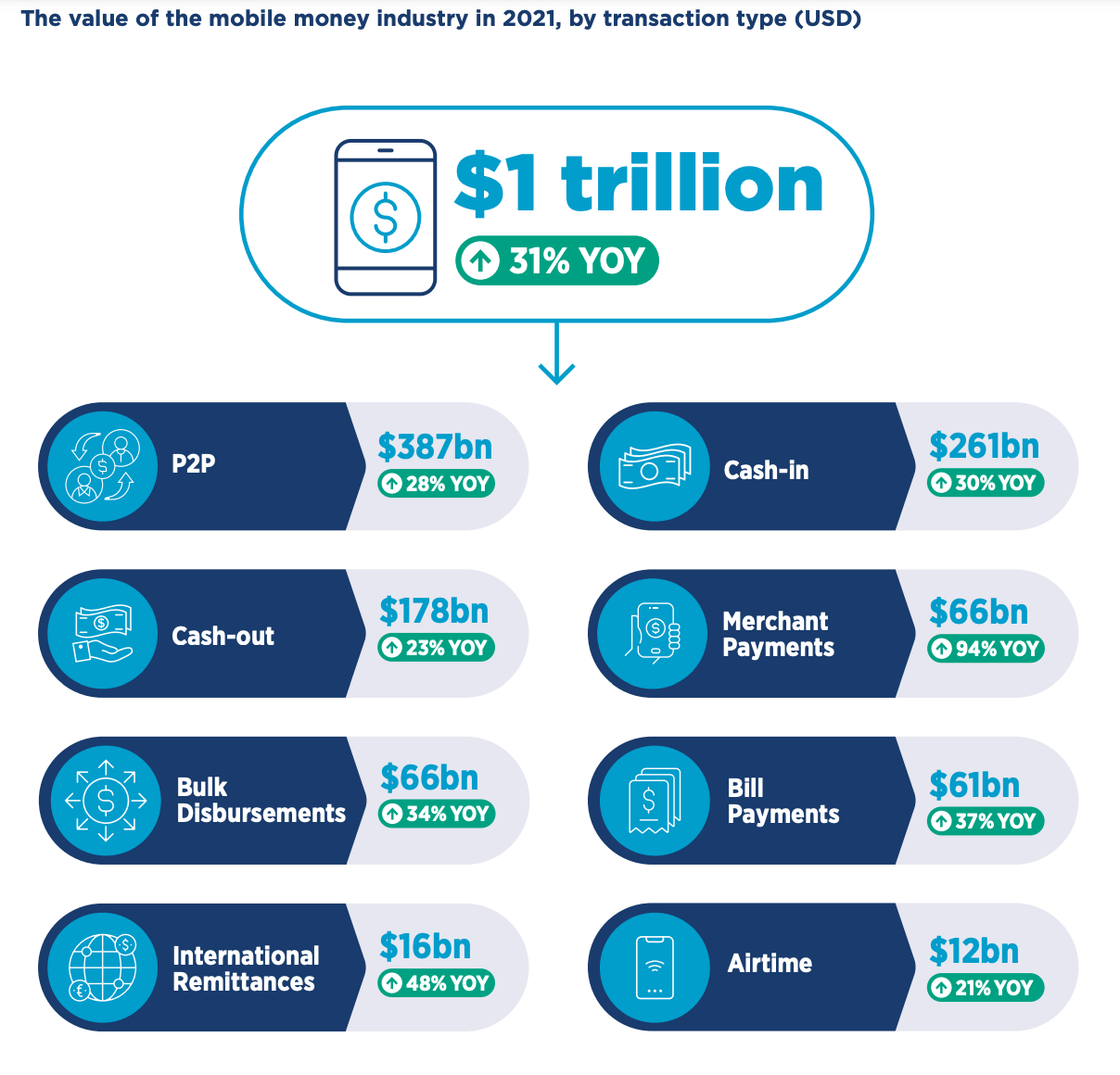

Over $1 trillion in transaction value was conducted using mobile money services in 2021. That was up 31% over 2020. Some of this massive growth happened because of COVID-19. It created a rush of people adopting these services.

So what kind of transactions are being done using these services? I’m glad you asked.

The largest type of transaction on these services is person-to-person (P2P). More than 1.5 million of these transactions were made EVERY HOUR in 2021. And more money was cashed in ($261 billion) versus cashed out ($178 billion) in 2021.

Where Are People Using These Services?

Mobile money services are being used by people who desperately need them the most. This is generally known as “unbanked” or “underbanked” communities. Usually developing countries where financial infrastructure isn’t great.

For example, the Middle East and North Africa (MENA) saw a 68% increase in new active accounts for 2021.

What’s great is the financial inclusion these services provide. And their ease of use for almost anyone. Senegal, in Northwest Africa, 71% of adults surveyed had used mobile money in the last 30 days.

Yet almost half in the survey struggled with reading or writing. These services are clearly taking the complexity out of financial transactions. And replacing that complexity with usability and simplicity.

The Crypto Opportunity

It seems that the adoption of cryptocurrencies for these mobile money services is an inevitability. There’s signs users will stick around - and want more financial services over the long-term.

More people are depositing into these systems than cashing out. This “digitization” is getting many people used to the idea of e-money instead of physical cash. And e-money is probably safer for many who don’t have banks to store physical cash in.

44% of mobile money services already offer credit, savings and insurance products. The service providers charge fees for these offerings, and they can scale up these businesses tremendously.

Another value add-on would be providing crypto features. Likely in the form of a stablecoin for savings to start. Then more investment-type cryptocurrencies, such as bitcoin or ether. These can be a gateway into the universe of DeFi, which already offers things like lending and insurance and is growing.

DeFi is Mostly in Developed Countries - For Now

A report by The Defiant has found that the United States is the biggest adopter of DeFi. But there is adoption in less developed countries for the technology too. Thailand, Ghana and Argentina show up in the report’s research of name-brand DeFi services and where they are used.

Mobile phones are empowering people around the globe. The global mobile opportunity for crypto is real. There are over 8.6 billion mobile phone subscribers on the planet - more subscriptions than people.

The adoption of smartphones is going to increase the use of more complex financial services - while providing usability for people. Another billion smartphones will be in use within four years, to 7.7 billion total, according to data aggregator Statistica.

![How Many People Have Smartphones? [Jan 2023 Update] | Oberlo How Many People Have Smartphones? [Jan 2023 Update] | Oberlo](https://substackcdn.com/image/fetch/$s_!mNFP!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F71d07375-2e66-4afc-a3ea-3c66d988ba6e_1760x900.jpeg)

So yeah, maybe the crypto market is in the doldrums right now. There is some fear of regulation and uncertainty. People have lost money.

It can be argued, though, that this is the calm before the storm of adoption for crypto. What are you doing to get ready for it?

A lot of research for this is from the 2022 Global System for Mobile Communications State of the Industry Report on Mobile Money.

They will have a 2023 report out in March, and I’ll do a refresher on this then.

Thanks for reading and please share this with your friends!