Ether's Value Prop

The world's second largest cryptocurrency network via market cap went through a big-ass incentive upgrade in 2022. Anyone notice?

Bitcoin is magic internet money, Ethereum is world computer crypto

The Ethereum world computer narrative seems to be taking hold

Crypto drama led many to forget about 2022’s Ethereum merge

Economic staking incentives exist for Ethereum investors post-merge

World Money

A while back, I looked at some of the fundamental elements of the Bitcoin network and its Magic Internet Money value proposition.

Store-of-value properties as well as proof-of-work hardware mining play key roles in appraising Bitcoin.

And when compared to Bitcoin, Ethereum has a much higher average transaction count.

Ethereum isn’t a great apples-to-apples comprison to Bitcoin, given the ability to create new cryptocurrencies on the network. Ethereum, as its own crypto network, has a totally different value prop than Bitcoin.

The plan all along for Ethereum has been utilizing proof-of-stake, where investors get a return on “staking” their ETH to support the network.

Taking Off

The founders of Ethereum wanted a network to build software applications with cryptocurrencies and blockchains.

This means smart contracts, which are then deployed to blockchains as “world computer” software.

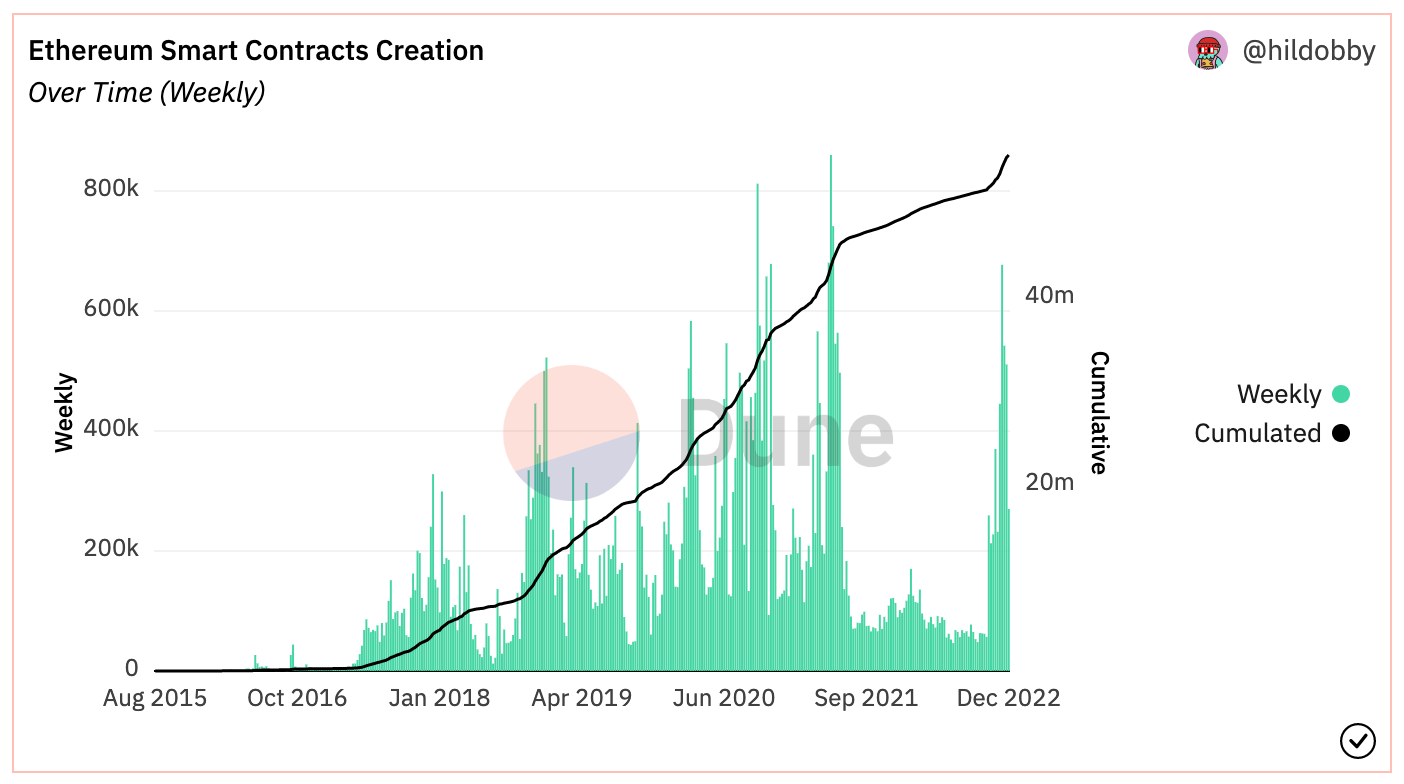

Smart contract creation on the Ethereum network has grown steadily over time, with over 800,000 created so far.

Smart contracts make up decentralized finance (DeFi) or web3. It’s the idea of using cryptocurrency, blockchains and smart contracts for software that isn’t centralized.

This includes decentralized exchange Uniswap, NFT market OpenSea, etc.

Ether, Post-Merge

Ethereum doesn’t use proof-ofwork mining like Bitcoin does, at least not anymore “post-merge”.

Many probably forget about the merge upgrade amid all the crypto drama in 2022, and Ethereum’s move to staking full-time.

Over the past 30 days, Ethereum has garnered $69.3 million worth of fees, according to Token Terminal. Ether proof-of-stakers willing to deploy 32 ETH for a one year lockup derive benefits from this usage.

Ethereum possesses steady yield (calculator here) in a down cycle. Because of this, ETH staking may increasingly become fashionable. Ether’s value prop ultimatley might be its smart contract capability and its continued use.

What other big staking networks also could become popular?