In the Wake of FTX's Debacle, How Has Bitcoin Price Remained Steady?

Bitcoin is still enjoying a relatively durable price given how many crypto firms have been damaged by the FTX fiasco.

Blink if you missed it, but bitcoin’s price has fallen to a 2-year low.

After I put out something about FTX’s ridiculous promotions during the last crypto hype cycle, someone commented they were surprised bitcoin was still trading at relatively high price levels.

Interestingly, upon examination, the market has substantially shifted over the last few weeks. Volatility, volume, liquidity and the Genesis effect is pervading this market.

Here’s what has happened, and why traders are in wait-and-see mode.

Volatility

One way to look at what’s occurred in the bitcoin market is to check its volatility. The Bitcoin Volatility Index, or BVIN, is one way to do that. The BVIN is similar to the implied volatility index or VIX, a famed stock market measure of volatility.

According to BVIN’s creators, from University of Sussex Business School, this indicator was at its highest back in 2020, during the beginning of pandemic lockdowns. BVIN hit a record 170% at that time.This high number indicated a high variance of price expected by traders over a 30-day period.

And for 2022, BVIN has hit its lowest levels the past week - 58%, on November 17 according to Glassnode. This suggests traders are sitting out right now, especially in the derivatives market.

Liquidity

One way cryptocurrencies behave differently than traditional markets comes from on-chain activity. Unlike stocks, for example, long-term bitcoin holders can simply remove their assets from exchanges - and we can all see it on the blockchain.

Data from Glassnode shows that the number of cryptocurrencies on exchanges is at the lowest it has been all year. On November 9, for example, as many were startled by the news of FTX suspending withdrawals, over 100,000 BTC left exchanges.

Big-time holders have removed liquidity from the bitcoin market. For example, 25,000 BTC was moved off of Gemini. The exchange’s now-suspended Gemini Earn program was working with embattled lender Genesis as a partner.

Volume

There has been talk of volume being affected by the vaporization of Alameda Research. Previously a big player , an “Alameda Gap” in the market, a giant whole where a big whale once was, is one factor in the crypto volume environment.

With year-to-date low volatility and low liquidity from crypto whales retreating from exchanges, the bitcoin market has transformed. Retail has disappeared, as indicated by Robinhood recently reporting a year-over-year 80% decline in crypto trading.

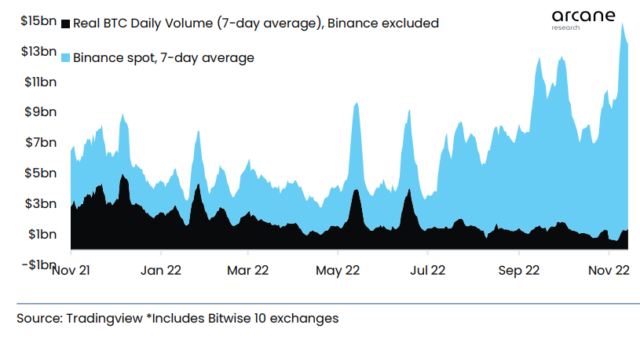

Data collected by Arcane research suggests that trading volumes are becoming more concentrated. Binance is now occupying more of the crypto trading market than ever before.

Genesis News

So then there’s the elephant in the room - Genesis. The lender is certainly in trouble, with a cascade of poor business decisions in a down market likely the culprit. A lot of people in crypto are talking about “contagion” - and for good reason.

From over-the-counter deals with failed stablecoin Terra, a $1.2 billion claim from the defunct Three Arrows Capital hedge fund, which resulted in parent company Digital Currency Group providing a $1 billion promissary note, Genesis is in trouble.

This relative calm volatility-wise in the crypto markets post-FTX is likely hanging on just what exactly is going to happen with Genesis and DCG. It seems like Genesis’ fate could be bankruptcy, as no one has emerged yet to scoop up these assets.

A bankruptcy by Genesis would be a bear event, while it’s possible a savior scooping up the spare parts could be seen as a bullish episode. Or, something else could happen - it’s crypto, and no one would have thought DCG would be in this position in the first place.

In a this environment, crypto prices are particularly vulnerable to price action as traders hit buy or sell on the impending Genesis news. It does feel, however, that the oxygen has escaped the crypto market and a news-driven event will spring traders into action, one way or another - soon.