Strategic Crypto MEME-Serve

When will a memecoin get into some government’s crypto reserve?

The cryptocurrency market cap has shot back up to over $3 trillion on Trump’s announcement of a strategic crypto reserve. Details are still scarce. But what’s known is the reserve includes assets such as BTC, ETH, SOL - and probably others. This comes ahead of a crypto summit being held at the White House on March 7.

Memecoins are surging along with the rest of crypto because of this news. The total memecoin market cap is now about $70 billion, with over $14 billion in daily volume. That’s a $10 billion increase in one day on crypto strategic reserve news!

This is the speed of crypto. And it moves in ever-faster cycles under the new cryptofication of America. Especially with a president that has his own memecoin.

Top cryptocurrencies like Bitcoin, Ethereum and Solana - plus whatever else goes into the newly-announced strategic crypto reserve by Trump - play a bigger role in meme-mania than people think. Think about the past crypto cycles and the place memecoins have had in them.

The top memecoins with at least a $1 billion market capitalization, according to CoinGecko, are from supercycles. There’s dogecoin from the Bitcoin days. There’s Shiba Inu and Pepe from the Ethereum. Then there’s Bonk and Trump from this most recent Solana jump.

So while it’s important to remember that memecoins have come and gone over the years, a select few do stay around. And they are spreading to more top blockchains over time.

The most recent chain was Solana. The SOL-based pump.fun cycle was powered by the idea of “fair” launch tokens - which really weren’t always that fair. The concept once felt like an improvement - no “presales”, which were subject to scrutiny over the years for insider profiting.

But pump.fun is susceptible to unfair problems, including “sniping” where bots are able to profit from price hikes in the early life of a token. Then there are the ever-popular “rugs" where a developer simply exits out of their holdings, leaving dumbstruck investors with a worthless crypto.

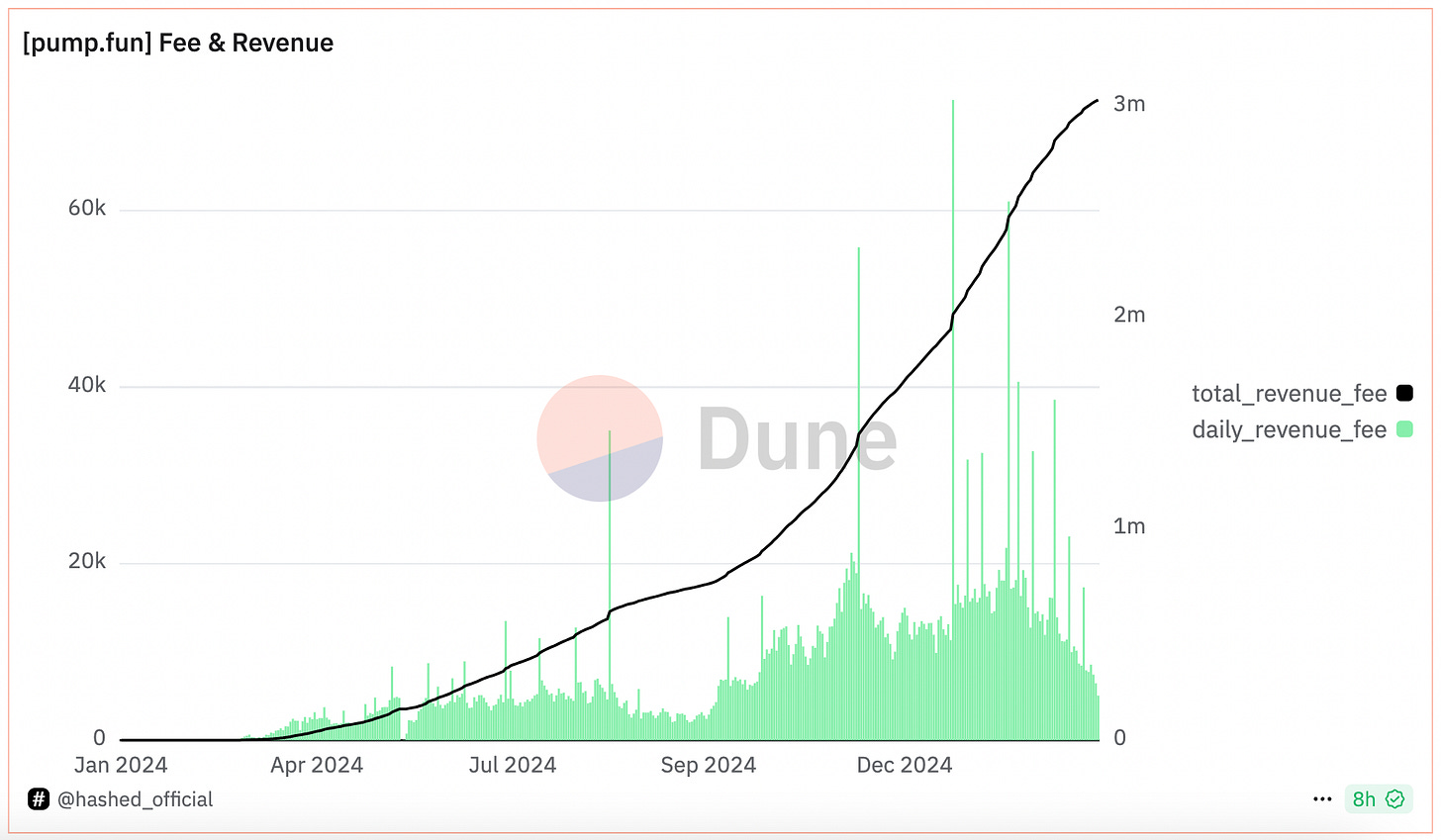

Regardless of fairness, pump.fun as a crypto business model works. The platform has made over $500 million in fees over its short lifetime since launching in early 2024.

People like the crypto casino, it’s a simple fact. And future memecoins will be launched by apps that have a better handle on making things fair for users while copying the pump.fun business model. Some of them could include personal tokenization concepts like Clout, or gamification methods like Yapster.

The SEC guidance on memecoins having little value and aren’t securities is important. Now it’s clear they aren’t securities, many will focus on their place as community-based tokens.

A memecoin doesn’t have value without a community. There are well over 200 tokens that were launched on pump.fun that still have a $1m market cap. People are still holding those cryptocurrencies. Community takeovers, or “CTOs” of existing memecoins many people already hold will continue. Powered by whenever a resurgent crypto market occurs, groups will resurrect older memes to give them new life.

So love them or hate them, but memecoins bring in new adopters. As much as many hate to believe it, memes are doing good work to build up better infrastructure in crypto.

Why? Increased crypto infrastructure results in other interesting things people adopt: Stablecoins, real-world assets (RWAs) and easy-to-use apps. Not just speculation. Just look at the stablecoin market, which just cracked the $200 billion market cap at the beginning of 2025. More stablecoins are coming, as it is likely Trump will get stablecoin regulation done for financial service companies.

So - yes, many come to memecoins for the crypto casino. But then many often stick around, exploring crypto and becoming a native.

What’s wrong with that? And when will a community get a memecoin into some government’s crypto reserve?

It’s going to happen. Probably sooner than we can even imagine.