Only 50% of DeFi Developers Build on Ethereum

Yet Ethereum does still bring in a lot of entrants

Top 200 blockchains outside of Bitcoin and Ethereum are influential

Developers entering crypto and DeFi often still discover Ethereum first

A Big Five group of blockchains developers build on might be rising

Ethereum not dominant chain anymore, as 50% of devs use something else

A few weeks ago, I wrote about crypto developers. It was discovered that most crypto software developers aren’t working on Bitcoin or Ethereum.

So what are they working on? Just like last time, I used the 185-page 2022 Electric Capital Developers Report as a guide.

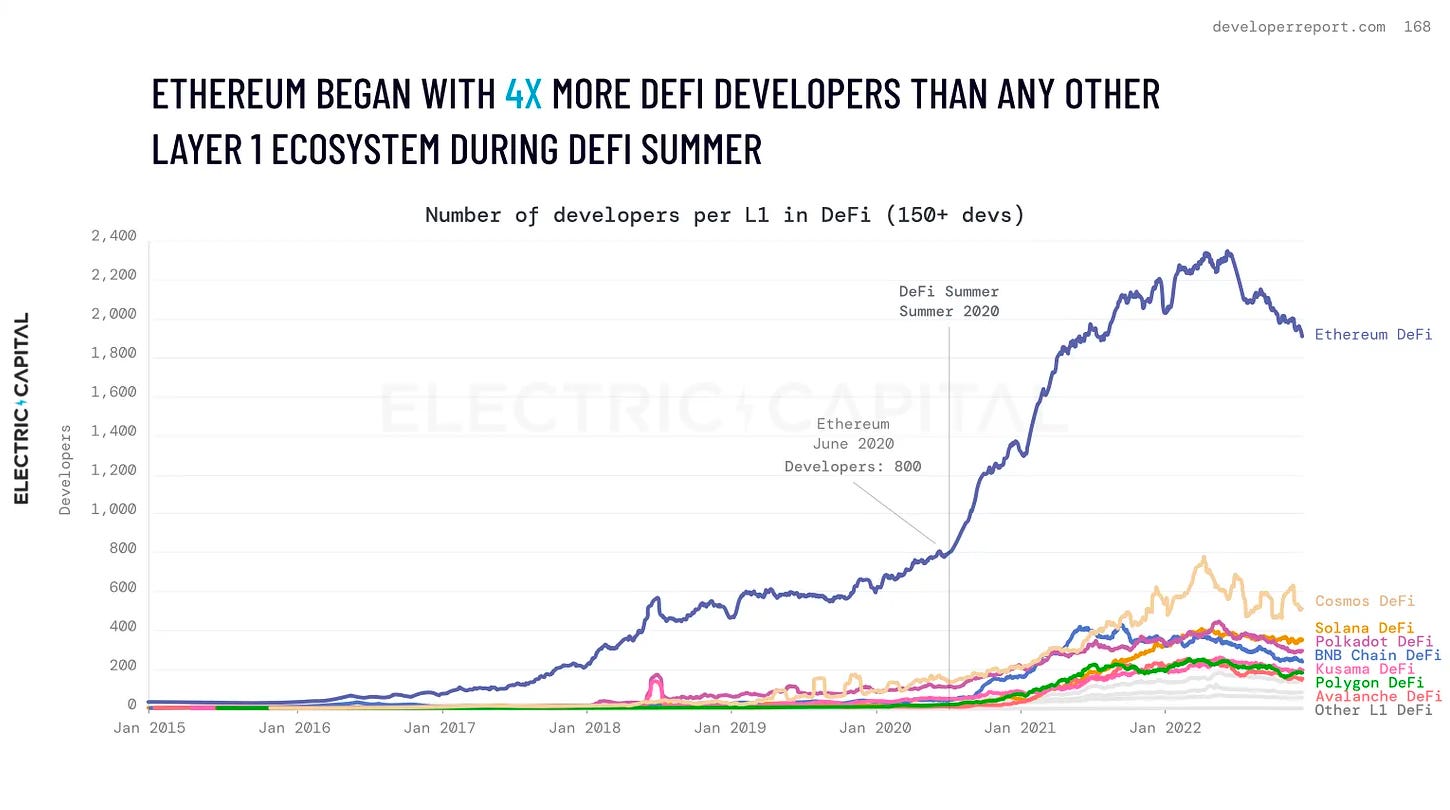

One of the biggest areas crypto developers are working on is DeFi - and that makes a lot of sense, given it underpins some of the market structure that makes crypto work.

“DeFi Summer” was in 2020 as programmers were at home during COVID lockdowns. It was a catalyst for programmers getting into crypto.

Top 200 Getting More Powerful

The top 200 blockchain ecosystems by market capitalization outside of Bitcoin and Ethereum are gaining traction. 50% of all active software developers are focused on top 200 blockchains, up from 25% in 2018.

It’s entirely possible many developers start with Ethereum, code smart contracts and learn how to use the EVM. Then they get excited about another blockchain for whatever reason.

A lot of entrepreneurs seemed to be getting motivated on starting something on smaller, lesser known blockchains. Which is great for the health of the crypto ecosystem overall. Diversity of chains is good.

The speed of adoption is staggering: There are over a dozen blockchain ecosystems in the top 200 with 50 full-time developers.

Some of this likely has to do with venture capital and promising token incentives, or perhaps both in some instances. But it’s working and getting software people interested in crypto.

The Ethereum Entry Point

It’s clear that the summer of 2020 was a turning point for the development of the cryptocurrency ecosystem. And because of Ethereum’s first-mover advantage, developers on that blockchain were 70% of the total DeFi developers at that time.

Cosmos, BNB Chain, Solana, Polkadot, Polygon, Avalanche and Kusama made substantial gains in developer share from 2020-2022. Yet Ethereum’s developer community is huge in terms of full-time developers.

This movement to other blockchains probably has to do with Ethereum’s scaling issues it experienced in 2020. Some of it probably has to do with technical details of these blockchains.

And then at least some of it probably has to do with the culture of a particular blockchain ecosystem that motivates a developer to join.

When it comes to DeFi in particular, it seems Ethereum, Cosmos and Solana are the biggest dogs in the fight right now.

We’ll see what happens with Solana in 2023, as it has been revealed FTX’s disgraced former CEO Sam Baloney-Fried (SBF) was a biger financial supporter of it than many knew.

Is There Now a Big Five?

The strength of the top 200 blockchains outside of Ethereum is promising. But there are a few chains grouped into that top 200 that may need to move into a Big Five programmable blockchain categorization.

This is because there are four ecosystems outside of Ethereum with more than 1,000 devs. Solana, Polygon, Comos and Polkadot are starting to look like they are moving ahead of the top 200 pack.

Major ecosystems are emerging beyond Bitcoin and Ethereum. Solana, Polkadot, Cosmos and Polygon grew from fewer than 200 devs in Jan 2018 to over 1,000 each by the end of 2022.

Of course, the overall speed developers could adopt another blockchain may render that moot. Outside of Bitcoin and Ethereum, the top 200 blockchains grew 12% year-over-year.

Things may move too fast to be able to group chains in the near-term. But the Big Five are indeed dominating for the time being.

Moving Forward

According to the Electric Capital report, by the end of 2022, 3,901 developers were working in DeFi on various blockchains. That’s a 240% increase since 2020’s DeFi summer.

Some may say a winter cycle has arrived for crypto. But progress has been made. Crypto just has seasons, and newer entrants will adjust to these cycles.

Also, the adoption rates for each of these larger breakout chains is all over the board. This makes it hard to predict where and how things will shake up. Some new chain could come out of nowhere and dominate in a way that’s not been seen since…

Ethereum.

To take a look at the 185-page 2022 Electric Capital Developers Report, check out the firm’s Github repository.