Regulation Kills Silvergate Exchange Network, Could Strangle Crypto Liquidity

Banking is critical to crypto

Silvergate Bank has been serving crypto exchanges since 2015

Well-known crypto exchanges will have a key service shuttered

Crypto has a long history of banking problems affecting the industry

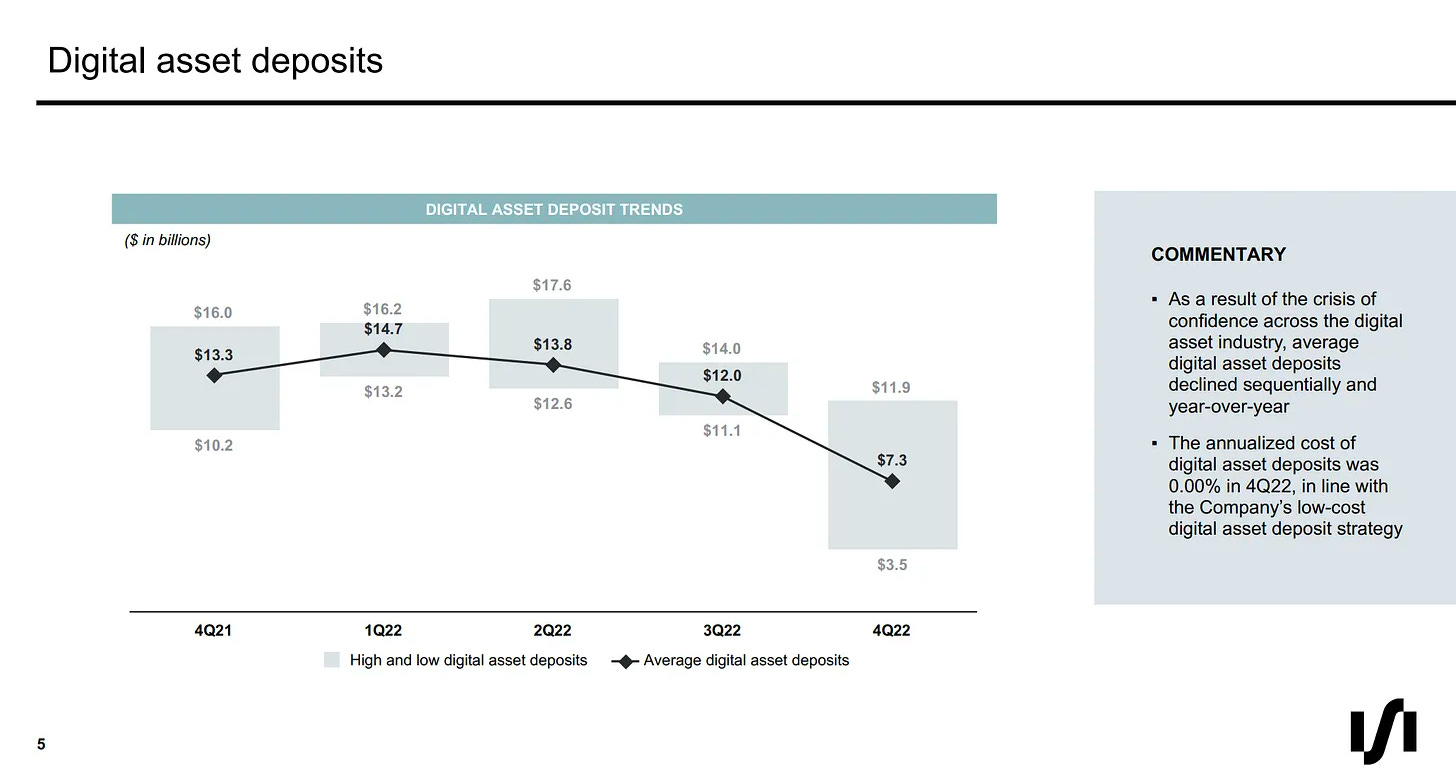

Silvergate saw billions of dollars of deposits withdrawn during 2022

Silvergate Bank, which has been serving cryptocurrency-focused businesses since 2015, is shutting down a key banking service for crypto exchanges.

The service is called Silvergate Exchange Network, or SEN. It allows Silvergate Bank customers to transfer funds to other interbank accounts. Exchanges and other crypto businesses can move fiat dollars at any time with this, matching the 24/7 nature of cryptocurrencies.

It’s been previously reported that Silvergate’s exchange customers have included Coinbase, Kraken, Paxos, Circle, Gemini, Crypto.com and Bitstamp.

It’s been a long slog for crypto businesses over the years to get banking, and this closure is likely a turning point for the industry. It’s a clear sign that regulators are going to strangle crypto by limiting fiat currency capabilities.

For cryptocurrency stakeholders deeply invested in the ecosystem, this could become problematic. Banking is critical to crypto and it’s not good to lose this type of liquidity product.

A Brief Banking Background

Cryptocurrency advocates have long believed blockchain technology could help reduce the influence of the banking sector. “Long Bitcoin, short the bankers,” is a well-known phrase used by a certain cryptocurrency influencer. This person clearly understood very little about the influence of banks on the rise of crypto.

Coinbase, founded in 2012, and the now-defunct Tradehill, started in 2011, were two early exchanges that were able to obtain banking during crypto’s nascent years. Tradehill was able to onboard with the Internet Archive Federal Credit Union, and Coinbase with Silicon Valley Bank.

However, Tradehilll struggled with Internet Archive Federal Credit Union’s antiquated technology. It couldn’t compete with the Coinbase-SVB partnership. Internet Archive Federal Credit Union eventually de-banked Tradehill due to a lack of regulatory clarity. The exchange, founded by Jered Kenna and Ryan Singer, shut down in 2013.

This is where Silvergate Bank enters the picture, previously known mostly as a construction lender based in La Jolla, CA. Somewhere along the way, around 2015, Silicon Valley Bank decided it didn’t want Coinbase as a customer. Silvergate then took the mantle, brought on Coinbase, and was off to the races.

Slow, Then Fast

For a period of time after onboarding Coinbase, Silvergate was very picky about bringing on cryptocurrency businesses as clients. Having a personal connection to the bank was one of the only ways to get onboarded. They carefully screened potential crypto clients.

But by 2017, Silvergate was bringing on many cryptocurrency customers. These customers included Alameda Research, which later founded the crypto exchange FTX in 2019. Alameda and FTX were more closely intertwined than many realized, with commingling (and spending) of customer funds taking place.

Volatile dollar liquidity is what has now led to the change in Silvergate’s policy recently. It has been revealed in public filings that Silvergate needed to tap into a U.S. government liquidity provider, Federal Home Loan Bank, for financial help in 2022. Lawmakers noticed, and began to scrutinize Silvergate post-FTX.

Cash Crunch

In announcing its Q4 financials back in January, Silvergate announced it used Federal Home Loan Bank at the end of 2022 for a $4.3 billion advance. The bank had at one point a whopping $17.6 billion in total crypto-related deposits in Q2 of 2022. However, the second half of the year saw bank deposits decline to as low as $3.5 billion while the FTX saga began to play out.

Speaking of FTX, and back to the subject of exchanges, they have loved using Silvergate. The Silvergate Exchange Network system and its 24/7 bank transfers between clients have been a key cog in crypto. SEN was responsible for $563 billion of dollar transfers between clients in 2022.

Now cryptocurrency businesses will need to go somewhere else for a similar service, if they can even find it. There are very few options. New York-based Signature Bank has a similar service called Signet. But that bank has made clear it is trying unload its crypto exposure, by up to $10 billion in deposits, not add to it.

As for Silvergate? It’s not looking good. Bloomberg is reporting the bank is delaying its annual report as it reviews whether the company is even viable anymore.