Stablecoin Saturation

Where do stable blockchain assets go from here?

June saw the massive IPO of Circle Internet Financial, provider of stablecoin USDC. Circle currently floats the second-highest number of stablecoins in circulation at $61 billion, with Tether at $157 billion in first place, according to CoinGecko. Stablecoins are now top of mind for many.

Why? Well, money of course. As of June 2025, the total stablecoin market capitalization reached approximately $250 billion, a significant increase from $208 billion in Q1 2025. Tether’s USDT holds a market cap of over $150 billion while USDC has grown to $60 billion. Ethena’s USDe, a newer entrant that has made significant progress since its 2024 launch, has a market cap of around $5.5 billion, making it the third-largest stablecoin in some metrics

So are we at peak stablecoin? Where do stable blockchain assets go from here?

A Booming Business Will Produce Copycats

With Circle’s attention in the public markets - its stock price moved from $31 at IPO to hundreds of dollars in short order during June - a stablecoin rush is on. But the stablecoin concept is not brand-new. Amazingly, stablecoins have been around for almost a decade already.

Stablecoins solved a huge problem back when banks would not service crypto companies. This made bank-based dollars in the ecosystem scarce. Tether was the first to jump on this in 2014 with its blockchain-based dollar, USDT, followed by Circle’s USDC in 2018. Blockchain bucks are aplenty in crypto-land now.

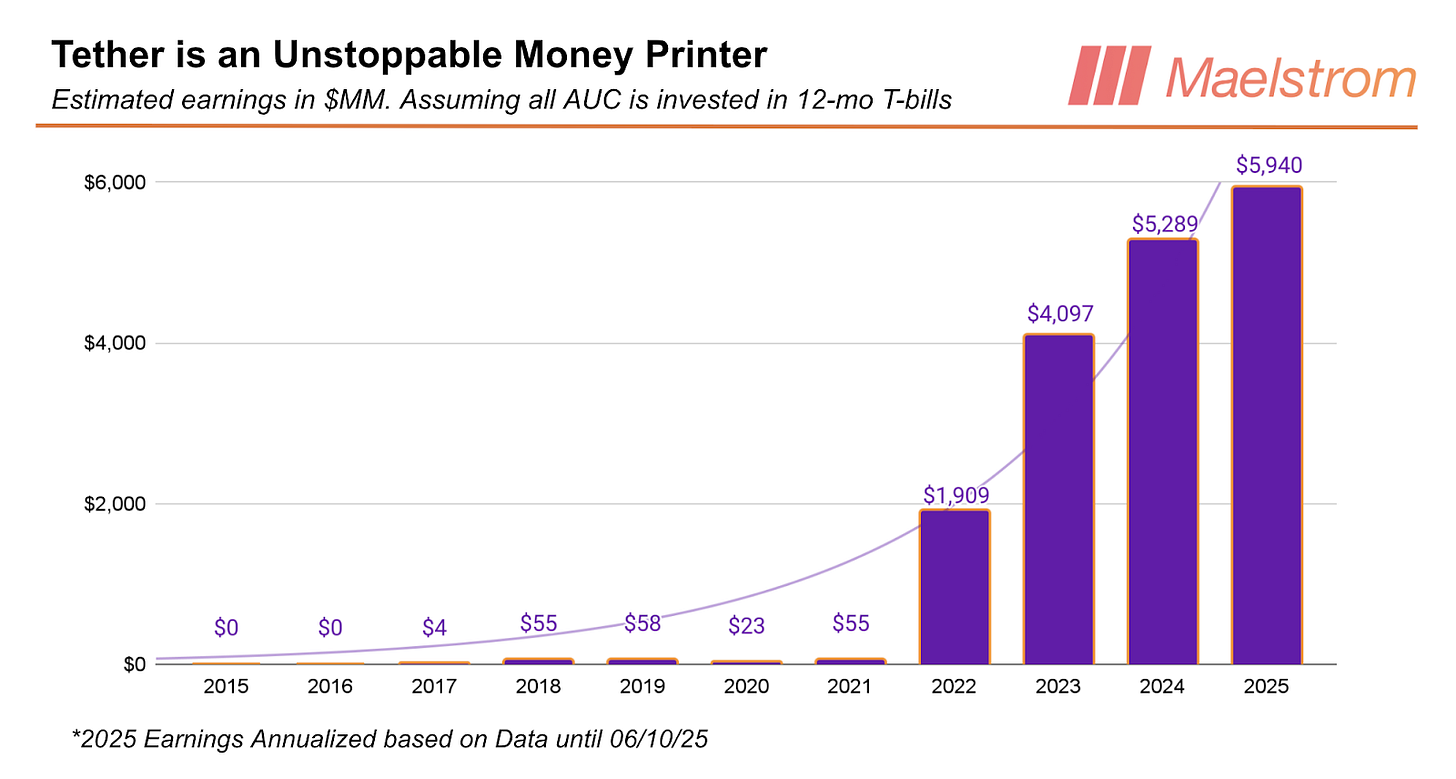

Issuers like Tether and Circle make a ton of money in the stablecoin business as a result of high interest rates. These companies use their float issuing stablecoins for cash to purchase Treasury Bills. This provides these companies cash flow in the form of net interest income, or NIM. It’s hugely profitable. Tether reported nearly $14 billion in profits in 2024, largely from interest on its $100 billion in U.S. Treasury bills.

Copycats are sure to follow this trend. Expect to see the issuance of many brand-new stablecoins as a result. But many emerging stablecoins may have trouble finding product-market fit with so many entrants already entrenched. It doesn’t make a lot of sense to issue yet another stablecoin unless it’s a bank or a government with a large moat.

Not New Stablecoins, But New Stablecoins Apps

Entrepreneurs should be thinking about using the existing stablecoins already in the ecosystem instead of creating new ones. The real opportunity is building programmable money apps that utilize stablecoins, replacing the need for consumer apps to rely so much on banks. This can mainstream users to the “onchain” world - dollars running on a blockchain rather than inside of a bank account.

Stablecoins enable “programmable money” applications, automating payments based on real-world conditions. In high-inflation economies like Argentina, for example businesses use USDC to preserve value. They can convert local currency to digital dollars instantly, reducing reliance on foreign bank accounts.

The stablecoin operators already in existence like Tether, Circle and possibly the DeFi-focused Ethena will be the providers for these apps. These stablecoin-based apps could be for shopping, gaming, prediction markets - applications where, with stable assets, there’s no need for traditional banking - it's replaced by blockchain. Payments provider Stripe is at the forefront of this, authorizing USDC payments in 2024, with transactions from over 70 countries in the first 24 hours.

Stablecoins Are the Method to the Masses

Stripe’s acquisition of stablecoin ramp Bridge in 2024 and wallet provider Privy in 2025 enhances onchain payment infrastructure for developers and entrepreneurs. This can reduce fees compared to traditional card transactions in apps by replacing them with onchain stablecoin payments.

Stablecoins are the best way to onboard more new users to blockchain. New apps that support stablecoins will almost be like stealth crypto exchanges: Users will onboard into stables and offramp back into dollars often without knowing it. Everything will just look like a dollar. This is the next stage of crypto’s adoption.

Apps that are powered by stablecoins, upending existing web2 apps using legacy banking and compliance, is the next step for blockchain adoption. And as stablecoins move mainstream, keep an eye on Ethereum. Most developers are familiar with Ethereum as the original smart contract programmable money chain, and the network has a massive $100B+ stablecoin market cap already.

So watch out - the next big payment or gaming app that becomes wildly popular might just be one that’s totally onchain. Stablecoins haven’t peaked. That’s because there is almost no mainstream user saturation for stablecoins yet - that sector is just warming up