What The Hell Happened to Ethereum?

Once a contender, now a settlement pretender?

There was once a time when Ethereum’s “world computer” concept seemed revolutionary and leading crypto innovation. But now it’s been surpassed by other, more centralized systems like Solana - to great success.

And even though people are currently shitting on Solana and hyping Ethereum because of the Argentina $LIBRA token scam, it’s mostly a distraction from the real issues at hand.

Ethereum’s decentralization mandate requires the network to currently use additional blockchains as scaling systems. And there’s probably no way to put that decentralization toothpaste back in the tube.

There’s been a number of amazing things Ethereum has accomplished. It launched the first really successful smart contract platform. It built the foundation for DAOs, DEXes, DeFi, NFTs and ultimately the web3 era. Ethereum even was able to audaciously move from proof-of-work to a proof-of-stake system with the “Merge” under co-founder Vitalik Buterin’s stewardship.

Problem is, Ethereum is moving into an entirely new phase. The network has an inability, due to decentralization desires on its base layer, to process enough transactions. This has necessitated “layer 2” blockchain solutions requiring users to be aware of which chain they are interacting with. And the introduction of “blobs” in 2024 for layer 2s to interact with the main chain has also hit limits, sometimes leading to an expensive fee market.

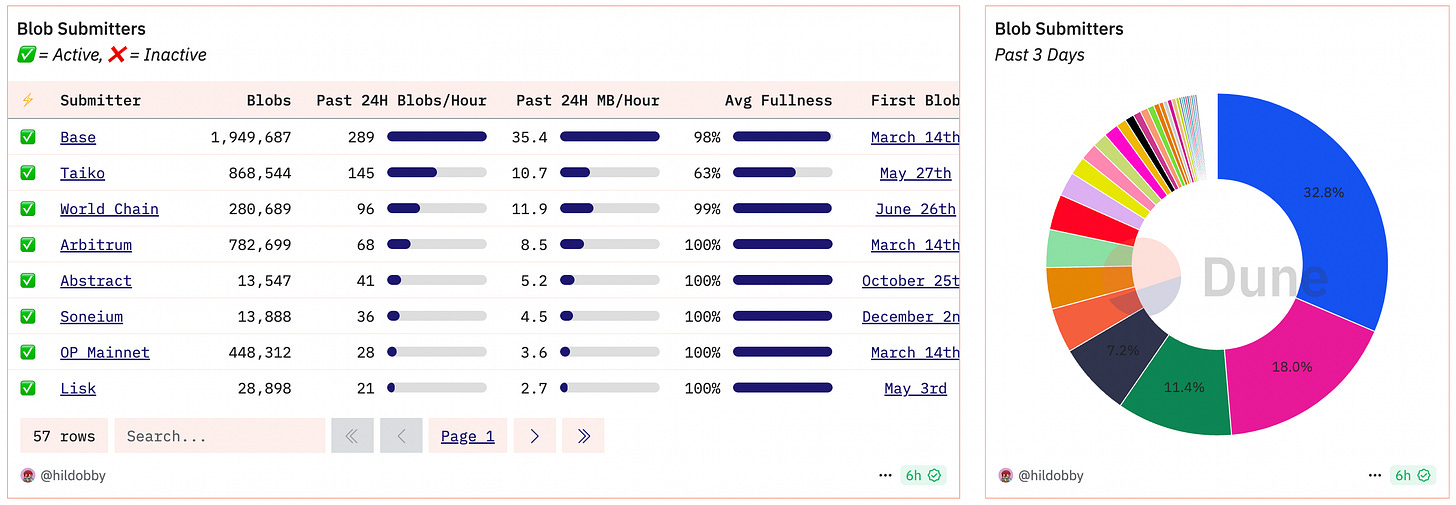

There is currently a propsal to increase the number of target blobs per block, but the argument - as usual - against this is that it further centralizes the network. Indeed, over 30% of blob usage can be attributed to a for-profit and centralized entity: Coinbase’s Base with 33%. Worldcoin’s World Chain comes in third at 11% of blob usage.

Meanwhile, Ethereum-heads are loving the Argentina scam, whose president tweeted endorsement of the Solana-based $LIBRA token. Only to have $100m of the liquidity quickly drained from the coin, known as a “rug-pull” scam.

The advent of pump.fun and other web3 user adoption apps on the more centralized Solana in 2024 has caused Ethereum trouble. This is evident when looking at Dexscreener: The majority of tokens being launched with any traction are on Solana, using pump.fun and then the Raydium DEX when they “graduate” when the market cap hits $100k. Very few launch on any of Ethereum’s chains, bullshit Argentina rug-pull cryptocurrencies be damned.

So it’s easy to forget there’s been general chaos in the Ethereum ecosystem with what appears to be a bit of an identity crisis. Vitalik Buterin’s management style has been under scrutiny as a result. Community members have advocated for a new Executive Director for the Ethereum Foundation.

Problem is, the Ethereum Foundation runs like a non-profit, which is what it is. It’s not led by a CEO-style executor or “killer” style manager at the top. This would explain the waffling Buterin is now doing to appease the community concerned about ETH prices, proposing a raise in the gas limit which would also - ironically- raise the level of centralization.

Exacerbating this issue is that the price of ETH has tanked. The market prices things in, and the future of Ethereum, and ether itself, is more likely to be that of a settlement layer. Sorry, but that seems to be the direction this is all going in.

I suspect some of the recent thrash in the Ethereum community is humans clashing with this dose of reality: Ethereum, like Bitcoin, is going to be a settlement layer. And while I have shit on layer 2 solutions in the past, my problem is really the additional blockchains with that solution, creating a Lasanga-like experience for users.

Problem is, when you put a mass crypto adoption hat on, no regular user will ever care about all of these additional chains on top of networks that don’t scale. No one cares about how email works, it just does, and at the speed of the internet. Remember, outside of enterprise, email didn’t get super popular until tech companies started creating dead-simple web-based versions like Hotmail and Gmail.

Isn’t that the point of web3 in the first place? Create a crypto-based and easy-to-use web free from the walled gardens of web2?

The better solution is using cryptography to move computation away from complex layer 2 blockchains. This is where real concepts like rollups come into play: Instead of a secondary chain, this technology just uses cryptography to secure computation, and then use blockchains as the transactional settlement layer for finality. State channels in Bitcoin’s Lightning network is an example of this, although is by no means a reference for any sort of high-level adoption.

So, what the hell happened to Ethereum? Well, maybe it’s just becoming what it is supposed to be: A decentralized settlement layer with smart contract capabilities. Solana is exciting - despite its centralization, people want high staking yields, speed and low fees - scams like Argentina coin be damned. Users simply don’t care about decentralization.

Maybe that’s why Ethereum staking is seeing a huge pullback. Maybe that’s why so many people are angling for change with the Ethereum Foundation. Bitcoin no longer has a Foundation, but ironically has a bunch of centralized players (public companies, governments, lobbying groups) advocating for it in ways Ethereum simply doesn’t.

Deflecting the issues with Ethereum by pointing out scams isn’t going to work to change the forward momentum of Solana.