The Crypto AI Bubble Burst. Its Next Run Could Get Weird.

Just pay the AI bot in crypto

In late 2024, AI-crypto projects like Virtuals and ai16z (later renamed to Eliza OS) became a popular narrative before fading badly. But the hype may eventually become a new, and strange, reality.

According to CoinMarketCap, the AI sector of crypto has seen a stark decline in market capitalization this year.

AI-related cryptocurrencies, mainly based on Ethereum, its layer 2 chains and Solana, hit a record-high $69B market cap in early 2025. That market cap is now around $16B as the sector fizzled along with the rest of crypto. But it will come back - it’s something to keep an eye on, because both crypto and AI aren’t going anywhere.

The AI-Crypto Use Case

Ribbit Capital, which put VC money into Coinbase, Solana and Privy, among others, made public a report recently describing a Cambrian explosion in cryptocurrencies that will be adopted by AI. These tokens will create buying demand from AI agents, Ribbit proclaims, purchased for artificial intelligence to complete a various tasks.

This could be highly impactful for crypto markets as AI becomes more efficient and precise over time. The first cycle for crypto AI agents is obviously over. But the category will experience a resurgence. One driver is the low cost for launching tokens.

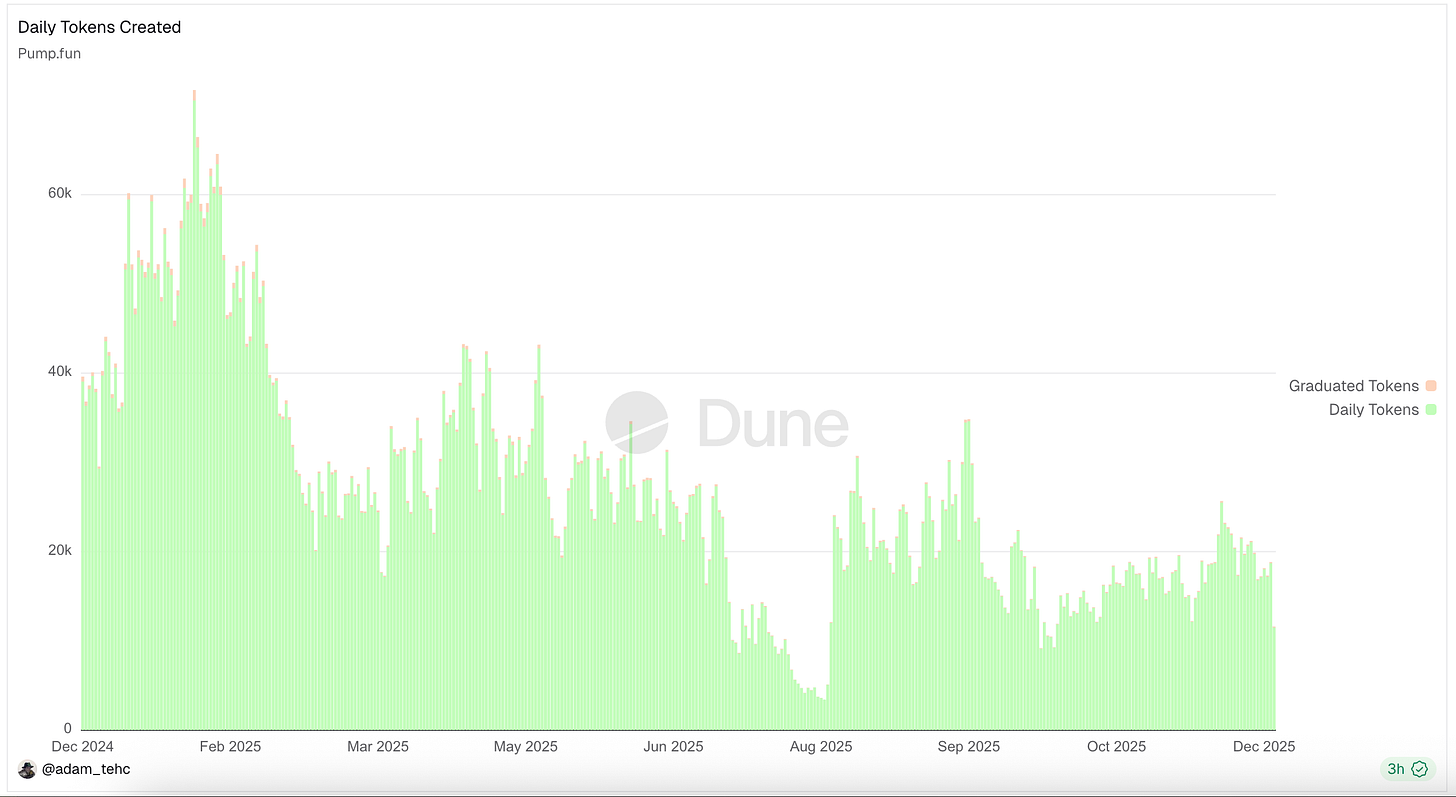

It used to be hard to launch new cryptocurrencies. But that complexity is gone - millions of tokens have been launched on the Solana-based launchpad Pump.fun. At least ten thousand are still being launched there everyday. Imagine the future - it’s going to be more token-heavy than most people could possibly dream.

Let the Agent do the Work

On Solana, it costs about $10 to launch a token, with onchain transaction fees under $0.02. Yes, this has meant the creation of really low-quality shitmemecoins. But cheap tokenization will lead the way for AI agents to do work more valuable than the cost of these cheap transaction fees. Pay an AI agent, to go do some work, even trading in the crypto markets, more precise and efficient than any human ever could.

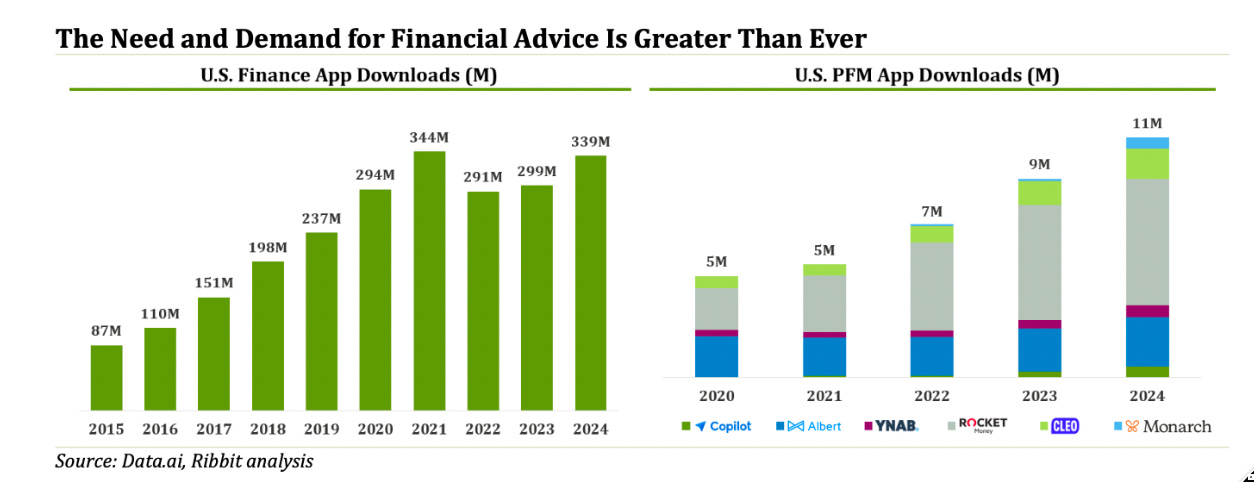

AI agents in the future will readily take cryptocurrencies from humans as payment to do things like financial analysis and trading. Ribbit Capital’s report noted over 330M financial app downloads in the U.S. for 2024, 11M of which were in personal financial management.

The demand for inexpensive financial services exists - and AI agents powered by and being paid small amounts of crypto could cheaply fill that need. Coinbase has already launched an AI-powered advisor in its wallet app. The logical evolution of this is AI agents taking crypto tokens for advice - financial or otherwise.

The Tokenization Unlock

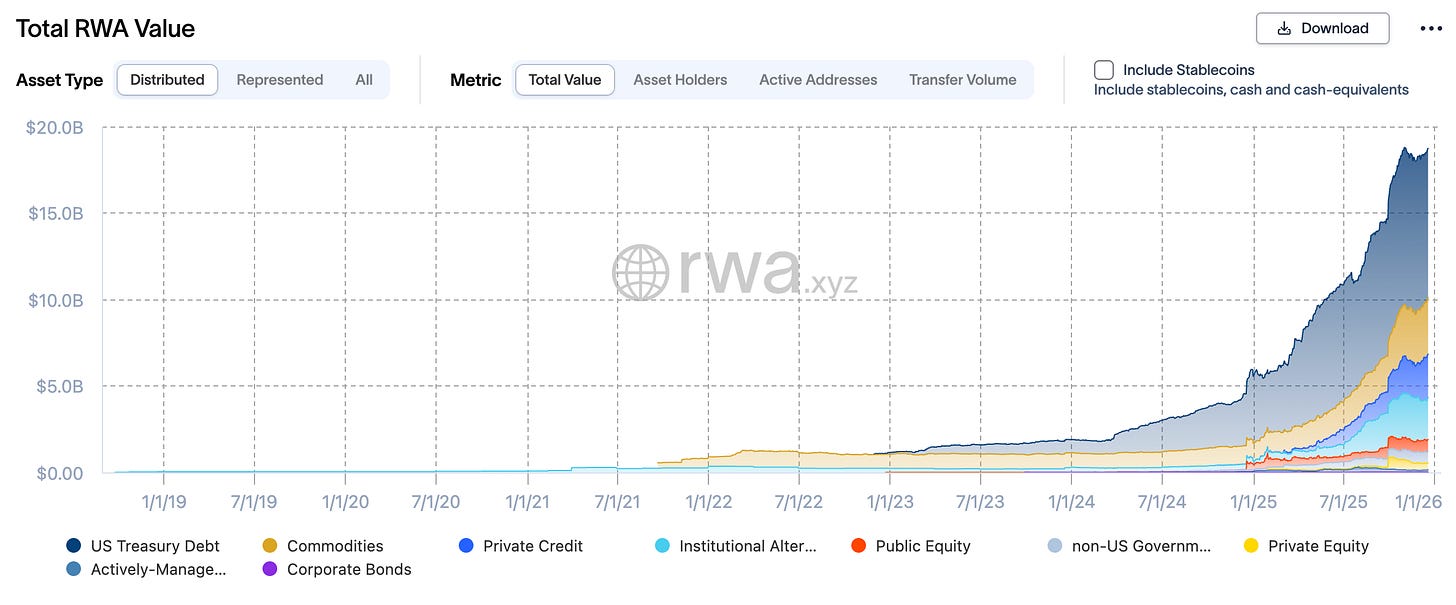

As AI agents take on tasks like financial advice, tokenized activity will increase as markets begin a slow march onchain. There’s currently a rush for assets to be placed on blockchains - RWA.xyz pegs that value currently around $18B. Tokenization can unlock brand-new markets, and it's probably going to be unleashed on previously closed-off value.

There are lots of closed markets that could be unlocked and tradable. Fairly illiquid advertising markets, such as Google’s $264 billion or Meta’s $164 billion of 2024 reported ad revenue, might make a lot of sense. Liquid ad markets for marketing spenders to unleash AI agents to get the best pricing could unlock every specific ad’s true worth.

But would controlling behemoths like Google or Meta want to open up thefloodgates of an onchain ad market? Definitely not. But this is coming even if incumbents dislike it. And ads are just one market example. Think about all the markets tokenization might unleash. Prediction markets are a great instance of this. They are monetizing and democratizing forecasting onchain. Prior to prediction markets, only closed-off sportsbooks were doing anything like this, taking bets on politics and the outcomes of games. Now that those gates are open, they aren’t going to close again.

Things Could Get Strange

The AI agent burst in late 2024 petered out. But a new cycle will happen was artificial intelligence and the tokenization of brand-new markets improves. But crypto and a heavy dose of AI, might also create some market havoc. Get the popcorn ready with traditional markets and crypto more intertwined than ever before due to favorable U.S. policy.

This was certainly the case during the October 10, 2025 flash crash that saw a massive $19.5B in liquidations supposedly due to a traditional finance macro event - tariffs. Or when a bot on Lighter sent a thinly-traded HYPE market to an inflated $98 price per token on October 27, 2025. Could AI-powered and highly tokenized crypto markets get even weirder that this?

Ribbit Capital’s token paper, while bullish, also acknowledges this, noting that, “the future will be stranger and more surprising”.

Can’t wait.