The SOL Still Burns

The Solana blockchain dream just won't die

In early 2025, the entire blockchain world was super bullish on the prospects of Solana, a top-ten cryptocurrency by market cap.

Solana was disrupting things so quickly in crypto that folks in the Ethereum world were madcappishly freaking out. They were calling for changes in foundational leadership, to eat its own dogfood, to find institutional product-market fit. Perma ether bulls Paradigm, a crypto VC fund backing a lot of Ethereum-based technology, even called out the need for the chain to focus, accelerate, accelerate!

One could argue Solana has found a product-market fit. The chain’s speed and megacheap layer-1 fees made for a perfect fit for the pump.fun memecoin craze. Say what you will about crypto speculation, but it brings in the people! Mass adoption incoming!

Now that the memecoin craze has fallen flat, that product-market fit is looking as volatile as owning a shitcoin itself. Since peaking at almost 400,000 active users at the end of January, pump.fun’s daily active and new users has fallen off a cliff.

Recently, I thought it appropriate to make a joke that upon the news of the U.S. government’s strategic crypto reserve, or some government might actually think about adding memecoins to a stockpile. I still think that might happen, because community strength is such a crypto superpower. But for the time being, the memecoin market is seriously pooping the bed.

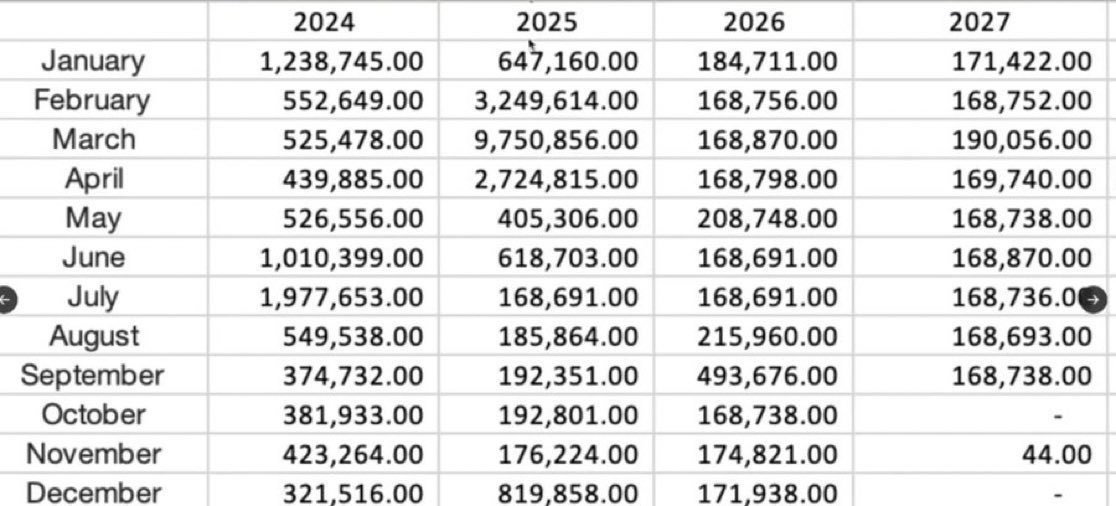

And as the memecoins go, so does Solana - at least for now. The price of SOL has retreated to a level not seen since May 2022. CoinDesk is making an assumption the average SOL holder is underwater. Exacerbating Solana’s problems are a massive amount of token unlocks that started happening in February 2025.

It’s not clear why the network decided early 2025 would be a good time to unlock 15 million SOL that investors other stakeholders possess. Perhaps far-off dates in the future portend a permabullish cycle to the moon-minded. Unfortunately, this release of tokens is happening a poor market time.

Maybe that’s a lesson other blockchains could learn from. On that note, there have been a lot of things that Solana has done that other early chains looking to grow should adopt.

1. Airdrop. In December 2023, during the bear market, staking platform Jito did a massive airdrop. It gave 100,000,000 JTO tokens to users who held SOL. At the time, bridging to other blockchains outside of the Solana chain wasn’t easy. So a lot of that wealth from those early Solana users stayed in the ecosystem.

2. Flywheel. The JTO airdrop brought attention to the ecosystem, with money flowing to go after opportunities. This includes Solana platforms previously without a token. The DEX Jupiter, for example, benefited from the Jito airdrop and earned lots of fees on trading. Jupiter launched their own JUP token in January of 2024.

3. Tokens. Solana, when compared to Ethereum’s ERC-20, turbocharges the token trading experience. There are no approvals for transfers and transaction fees are megacheap - making deploying new assets much easier. Solana tokens are, simply put, more efficient relative to the ERC-20 standard (insert sorry sad-face Vitalik).

4. DeFi. After the Jito airdrop and Jupiter started fueling the network, DeFi apps appeared on Solana in 2024. Pump.fun, Raydium DEX, Drift perp swaps, etc. DeFi on the Solana network was pretty nascent when compared to Ethereum to start out with. However, by January 2025, Solana was soundly beating Ethereum DEX volumes.

5. Memecoins. Everybody’s favorite casino after Binance, pump.fun launched exactly into the hockey stick price growth of SOL (see price chart above). Remember now, Jito airdropped big bucks in Dec 2023, then Jupiter exacerbated it in Jan 2024. Pump.fun launched hysteria allowing people toss SOL at thousands of memes.

6. Loop. Ever heard of a self-reinforcing loop? All of these elements above have created a rinse and repeat mechanic that has propelled Solana to fresh highs in blockchain usage. The ingredients are simple. Bring on the speculation. Build the right DeFi. Launch products that feed off of liquidity. Crypto users will be the worker bees.

Despite the down market and SOL’s price exacerbated by massive token unlocks, the blockchain hit on a lot of things to make it successful. People can hate on Solana all they want for certain aspects of its ecosystem. And these massive SOL unlocks on a prayer there would be “crypto spring” around this time are going to depress prices for a while in 2025.

Yet the SOL still burns. Brightly.

Thanks to Wit Smieszek for insight into this.